rub-downs is much stronger, averaging 85 per cent, or 90 per cent. Investigations carried out in Germany have demonstrated that the best strength for general, miscellaneous uses is 95 per cent, and that is the strength which we, as consumers, should insist upon.

It is readily figured out that such alcohol at the present time must pay a tax of $2.08 the measured gallon. The wholesale price is in the neighborhood of $2.50 per gallon, of which we may estimate the government gets $2.08, the distilleries 42 cents.

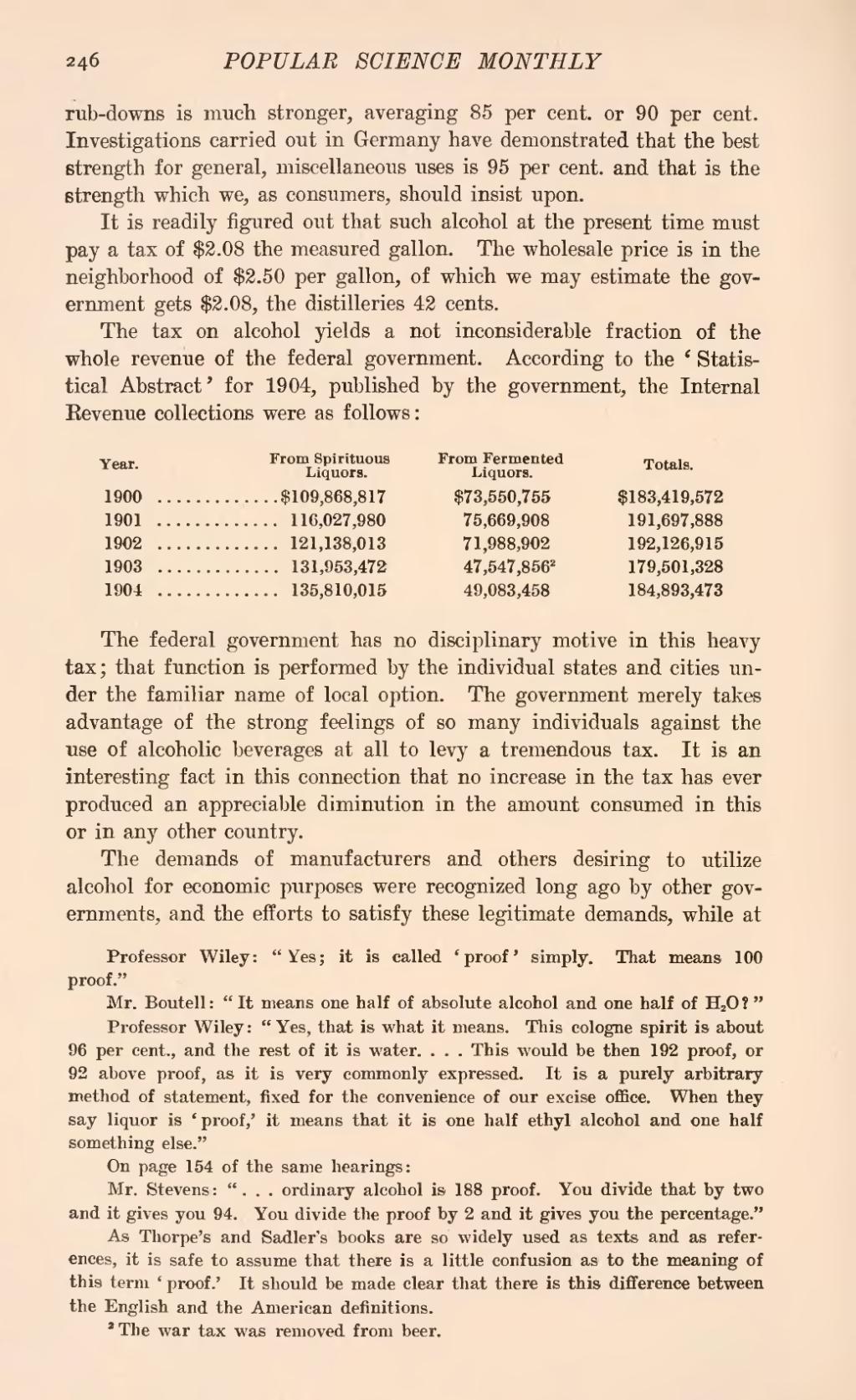

The tax on alcohol yields a not inconsiderable fraction of the whole revenue of the federal government. According to the 'Statistical Abstract' for 1904, published by the government, the Internal Revenue collections were as follows:

| Year | From Spirituous Liquors. |

From Fermented Liquors. |

Totals |

| 1900 | $109,868,817 | $73,550,755 | $183,419,572 |

| 1901 | 116,027,980 | 75,669,908 | 191,697,888 |

| 1902 | 121,138,013 | 71,988,902 | 192,126,915 |

| 1903 | 131,953,472 | 47,547,856[1] | 179,501,328 |

| 1904 | 135,810,015 | 49,083,458 | 184,893,473 |

The federal government has no disciplinary motive in this heavy tax; that function is performed by the individual states and cities under the familiar name of local option. The government merely takes advantage of the strong feelings of so many individuals against the use of alcoholic beverages at all to levy a tremendous tax. It is an interesting fact in this connection that no increase in the tax has ever produced an appreciable diminution in the amount consumed in this or in any other country.

The demands of manufacturers and others desiring to utilize alcohol for economic purposes were recognized long ago by other governments, and the efforts to satisfy these legitimate demands, while at

- ↑ The war tax was removed from beer.

Professor Wiley: "Yes; it is called 'proof simply. That means 100 proof."

Mr. Boutell: "It means one half of absolute alcohol and one half of ?"

Professor Wiley: "Yes, that is what it means. This cologne spirit is about 96 per cent., and the rest of it is water. . . . This would be then 192 proof, or 92 above proof, as it is very commonly expressed. It is a purely arbitrary method of statement, fixed for the convenience of our excise office. When they say liquor is 'proof,' it means that it is one half ethyl alcohol and one half something else."

On page 154 of the same hearings:

Mr. Stevens: ". . . ordinary alcohol is 188 proof. You divide that by two and it gives you 94. You divide the proof by 2 and it gives you the percentage."

As Thorpe's and Sadler's books are so widely used as texts and as references, it is safe to assume that there is a little confusion as to the meaning of this term 'proof.' It should be made clear that there is this difference between the English and the American definitions.