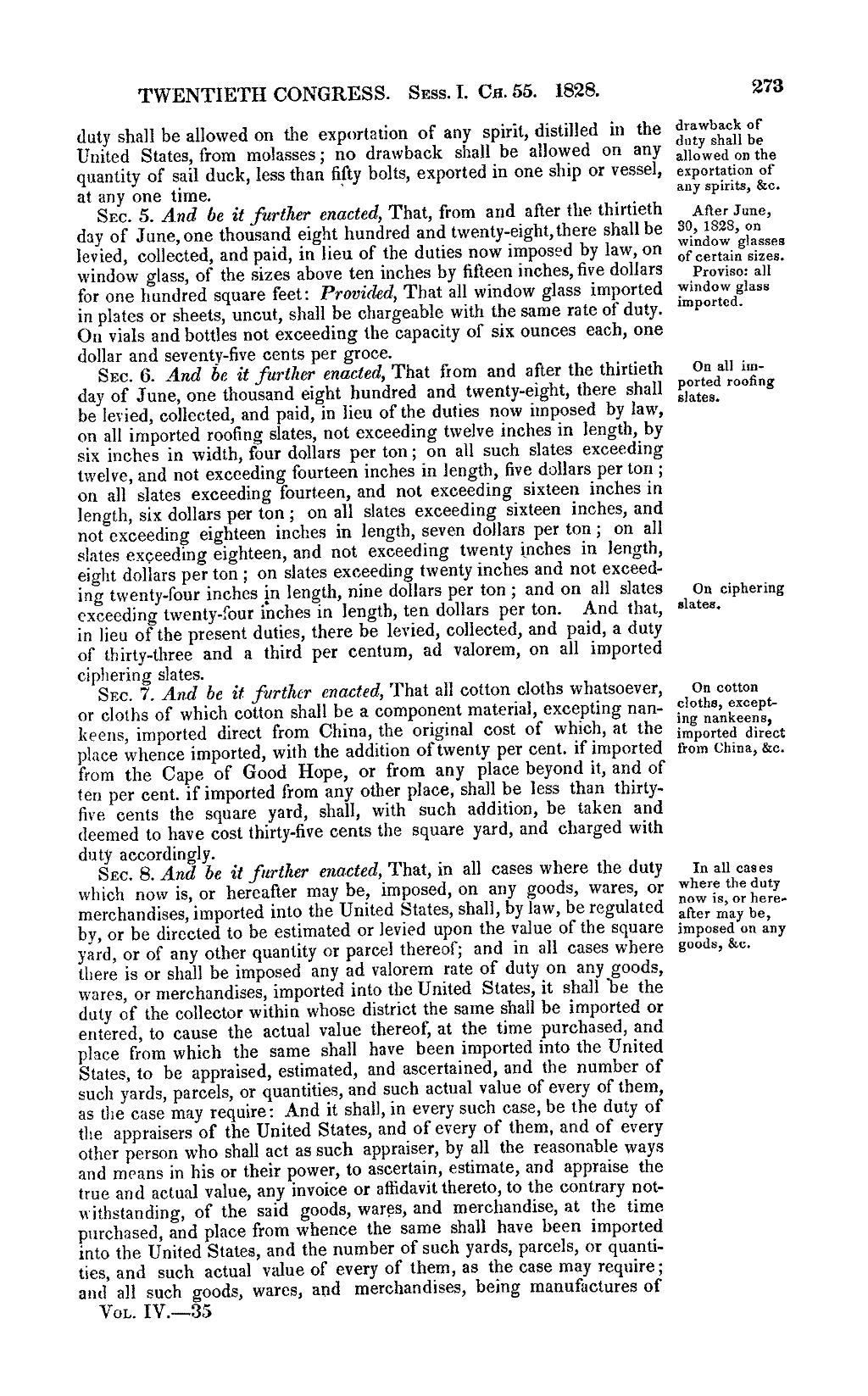

duty shall be allowed on the exportation of any spirit, distilled in the United States, from molasses; no drawback shall be allowed on any quantity of sail duck, less than fifty bolts, exported in one ship or vessel, at any one time.

After June, 30, 1828, on window glasses of certain sizes.

Proviso: all window glass imported.Sec. 5. And be it further enacted, That, from and after the thirtieth day of June, one thousand eight hundred and twenty-eight, there shall be levied, collected, and paid, in lieu of the duties now imposed by law, on window glass, of the sizes above ten inches by fifteen inches, five dollars for one hundred square feet: Provided, That all window glass imported in plates or sheets, uncut, shall be chargeable with some rate of duty. On vials and bottles not exceeding the capacity of six ounces each, one dollar and seventy-five cents per groce.

On all imported roofing slates.Sec. 6. And be it further enacted, That from and after the thirtieth day of June, one thousand eight hundred and twenty-eight, there shall be levied, collected, and paid, in lieu of the duties now imposed by law, on all imported roofing slates, not exceeding twelve inches in length, by six inches in width, four dollars per ton; on all such slates exceeding twelve, and not exceeding fourteen inches in length, five dollars per ton; on all slates exceeding fourteen, and not exceeding sixteen inches in length, six dollars per ton; on all slates exceeding sixteen inches, and not exceeding eighteen inches in length, seven dollars per ton; on all slates exceeding eighteen, and not exceeding twenty inches in length, eight dollars per ton; on slates exceeding twenty inches and not exceeding twenty-four inches in length, nine dollars per ton;On ciphering slates. and on all slates exceeding twenty-four inches in length, ten dollars per ton.

On cotton cloths, excepting nankeens, imported direct from China, &c.Sec. 7. And be it further enacted, That all cotton cloths whatsoever, or cloths of which cotton shall be a component material, excepting nankeens, imported direct from China, the original cost of which, at the place whence imported, with the addition of twenty per cent. if imported from the Cape of Good Hope, or from any place beyond it, and of ten per cent. if imported from any other place, shall be less than thirty-five cents the square yard, shall, with such addition, be taken and deemed to have cost thirty-five cents the square yard, and charged with duty accordingly.

In all cases where the duty now is, or hereafter may be, imposed on any goods, &c.Sec. 8. And be it further enacted, That, in all cases where the duty which now is, or hereafter may be, imposed on any goods, wares, or merchandises, imported into the United States, shall, by law, be regulated by, or be directed to be estimated or levied upon the value of the square yard, or of any other quantity or parcel thereof; and in all cases where there is or shall be imposed any ad valorem rate of duty on any goods, wares, or merchandises, imported into the United States, it shall be the duty of the collector within whose district the same shall be imported or entered, to cause the actual value thereof, at the time purchased, and place from which the same shall have been imported into the United States, to be appraised, estimated, and ascertained, and the number of such yards, parcels, or quantities, and such actual value of them, as the case may require: And it shall, in every such case, be the duty of the appraisers of the United States, and of every of them, and of every other person who shall act as such appraiser, by all the reasonable ways and means in his or their power, to ascertain, estimate, and appraise the true and actual value, any invoice or affidavit thereto, to the contrary notwithstanding, of the said goods, wares, and merchandise, at the time purchased, and place from whence the same shall have been imported into the United States, and the number of such yards, parcels, or quantities, and such actual value of every of them, as the case may require; and all such goods, wares, and merchandises, being manufactures of