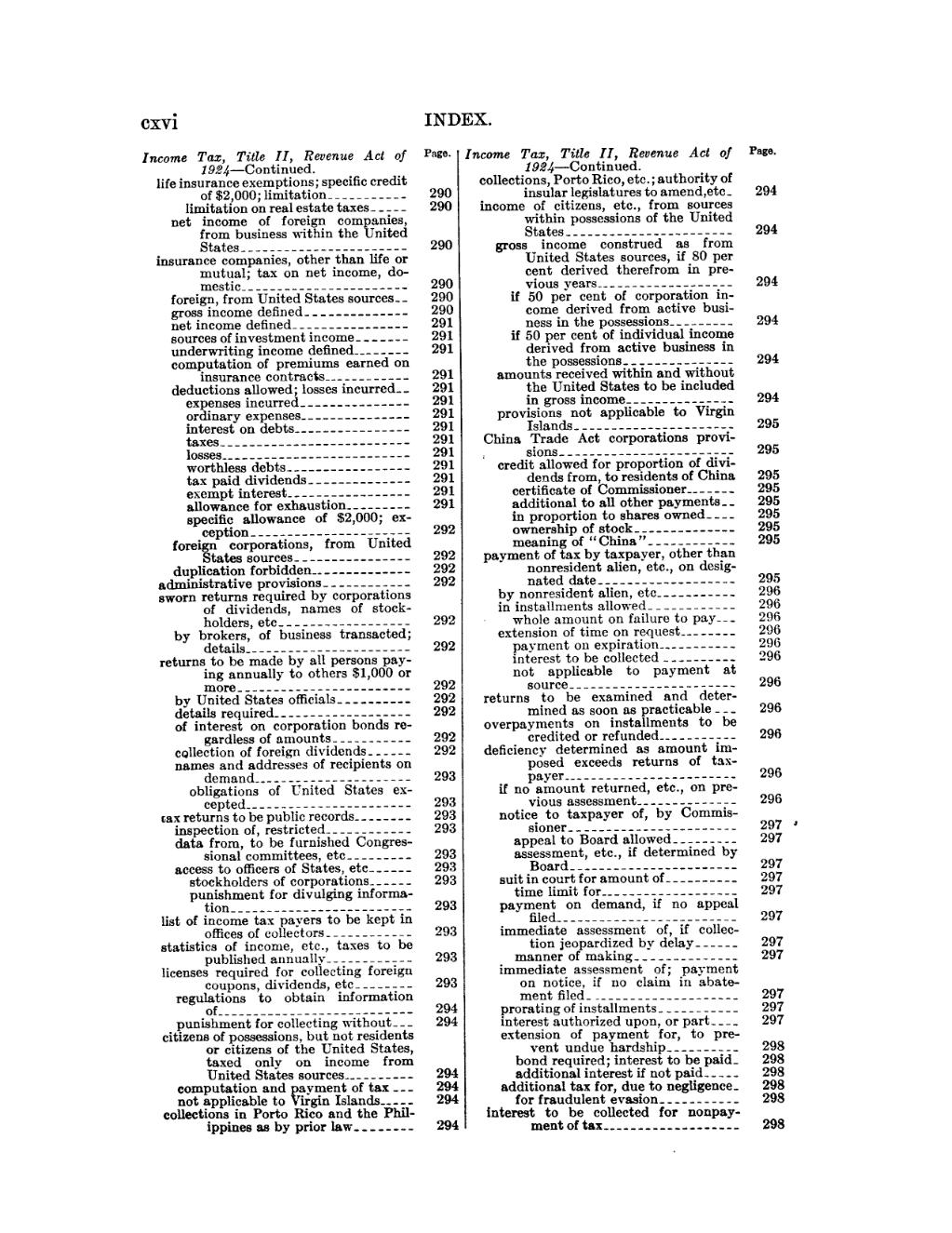

GXV1 INDEX. Income Tax, Title II, Revenue Act of Page Income Tax, Title II, Revenue Act of H86- 1 924—Continued. 1 924——Continued. life insurance exemptions; specific credit collections, Porto Rico, etc. ; authority of of $2,000; limitation _.. 290 insular legislatures to amend,etc- 294 limitation on real estate taxes . 290 income of citizens, etc., from sources net income of foreign companies, within possessions of the United from business within the United States ... 294 States ... 290 gross income construed as from insurance companies, other than life or United States sources, if 80 per mutual; tax on net income, do- cent derived therefrom in premestic ,.. 290 vious years- .. 294 foreign, from United States sources-- 290 if 50 per cent of corporation ingross income defined - . 290 come derived from active businet income defined 291 ness in the possessions . 294 sources of investment income ... 291 if 50 per cent of individual income underwriting income defined . --- 291 derived from active business in computation of premiums earned on the possessions ... 294 insurance contracts 291 amounts received within and without deductions allowed; losses incurred-- 291 the United States to be included expenses incurred ... 291 in gross income ... 294 ordinary expenses ... 291 provisions not applicable to Virgin interest on debts ... - 291 Islands .. 295 taxes .. 291 China Trade Act corporations provilosses . - 291 , sions 295 worthless debts . 291 credit allowed for proportion of divitax paid dividends .. 291 dends from, to residents of China 295 exempt interest . 291 certificate of Commissioner- .. 295 allowance for exhaustion --...-... 291 additional to all other payments-- 295 specific allowance of $2,000; ex- in proportion to shares owned -.-- 295 ception .-.---------------.. -- 292 ownership of stock -.-.-.--..-.-. 295 foreign corporations, from United meaning of “China" .-----.. 295 States sources -..-.---.- - .--.. 292 payment of tax by taxpayer, other than duplication forbidden-- ..-. 292 nonresident alien, etc., on desigadministrative provisions ..--.-----.. 292 nated date -..-.--...-----...- 295 sworn returns required by corporations by nonresident alien, etc ..---...-.- 296 of dividends, names of stock- in installments allowed ------ - ..-.. 296 holders, etc ---------.------.- 292 » whole amount on failure to pay--- 296 by brokers, of business transacted; extension of time on request ---.---- 296 details -------..- - .----------. 292 payment on expiration- ------..-- 296 returns to be made by all persons pay- interest to be collected ------.-.- 296 ing annually to others $1,000 or not applicable to payment at more -----------------.---.-. 292 source ------------------.-.-- 296 by United States officials ---.-- ---- 292 returns to be examined and deterdetails required -.-.-..-.-.--.-...- 292 mined as soon as practicable - - - 296 of interest on corporation bond re- overpayments on installments to be gardless of amounts -..-.-- 292 credited or refunded- -----..--. 296 collection of foreign dividends .----- 292 deficiency determined as amount imnames and addresses of recipients on posed exceeds returns of taxdemand ----- - ---.------------ 293 payer ---------- - --------..-.- 296 obligations of United States ex- if no amount returned, etc., on precepted --------------..----.-- 293 vious assessment -------------- 296 tax returns to be public records ---- ---- 293 notice to taxpayer of, by Commisinspection of, restricted ------------ 293 sioner ------------------.---- 297 ·‘ data from, to be furnished Congres— appeal to Board allowed --------- 297 sional committees, etc --.---.-. 293 assessment, etc., if determined by access to officers of States, etc ---..- 293 Board --------.--------..-.-- 297 stockholders of corporations ------ 293 suit in court for amount of ---------- 297 punishment for divulging informa- time limit for- ----------------.- 297 tion -.----------------------- 293 payment on demand, if no appeal list of income tax payers to be kept in Bled ------------------------_ 297 offices of collectors ------------ 293 immediate assessment of, if collecstatistics of income, etc., taxes to be tion jeopardized by delay ------ 297 published annually ------------ 293 manner of making -_-,-------___ 297 licenses required for collecting foreign immediate assessment of; payment coupons, dividends, etc -------- 293 on notice, if no claim in abateregulations to obtain information ment filed- - ___________________ 297 of --..---..-----.-..--... 294 prorating of installments ,___---_ _ _ _ 297 punishment for collecting without-- - 294 interest authorized upon, or part -.-- 297 citizens of possessions, but not residents extension of payment for, to preor citizens of the United States, vent undue hardship ---------- 298 taxed only on income from bond required; interest to be paid- 298 United States sources- -----..-- 294 additional interest if not paid ----- 298 computatmn and payment of tax --- 294 additional tax for, due to negligence- 298 not applicable to 'xrgm Islands- -..- 294 for fraudulent evasion -.--------- 298 collections in Porto Rico and the Phil- interest to be collected for nonpay- xppines as by prior law ----.--. 294 ment of tax ___________________ 293