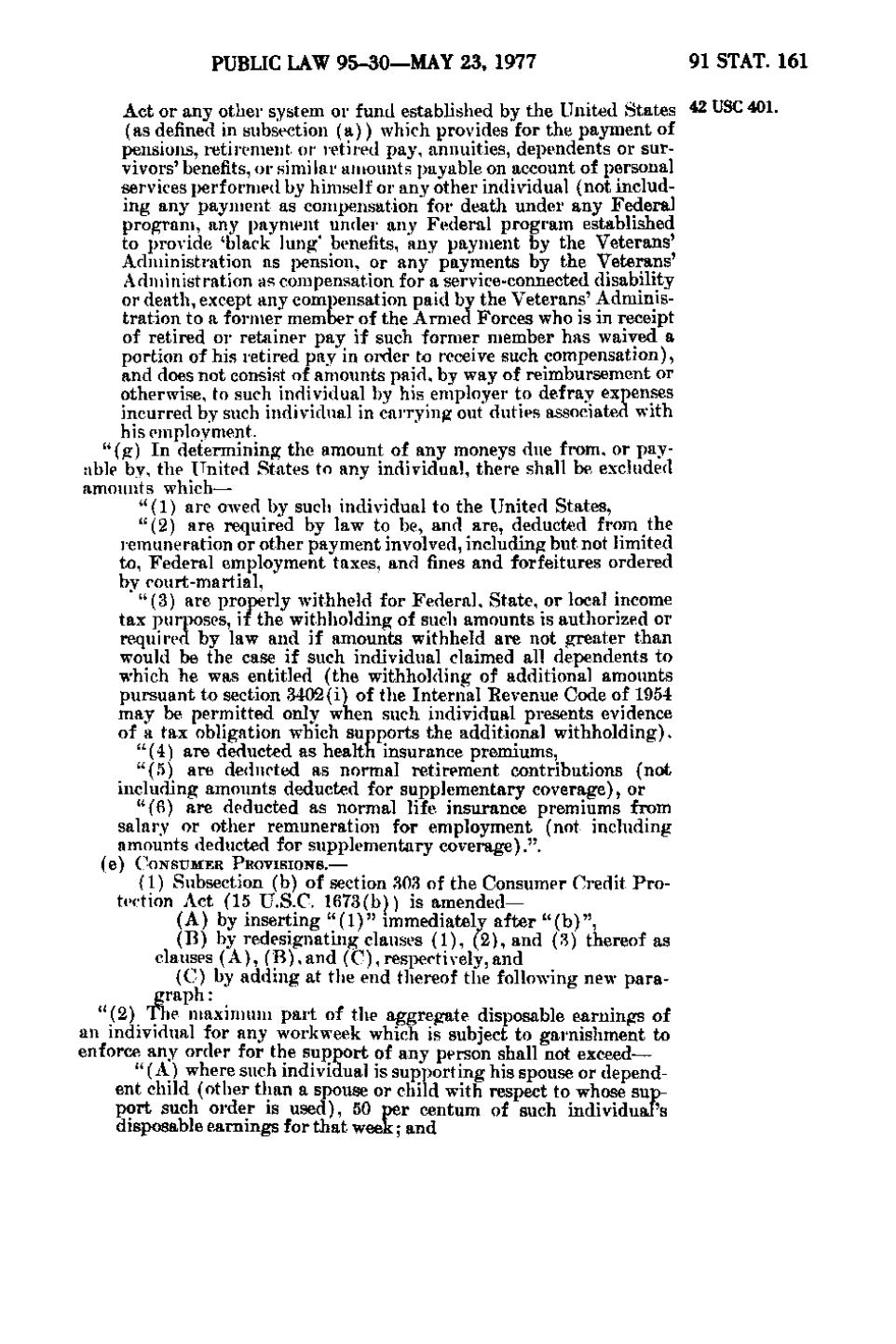

PUBLIC LAW 95-30—MAY 23, 1977

91 STAT. 161

Act or any other system or fund established by the United States 42 USC 401. (as defined in subsection (a)) which provides for the payment of pensions, retirement oi- retired pay, annuities, dependents or survivors'benefits, or similar amounts payable on account of personal services performed by himself or any other individual (not including any payment as compensation for death under any Federal program, any payment under any Federal program established to provide 'black lung' benefits, any payment by the Veterans' Administration as pension, or any payments by the Veterans' Administration as compensation for a service-connected disability or death, except any compensation paid by the Veterans' Adminis, .. - ~ tration to a for-mer member of the Armed Forces who is in receipt

- "

of retired or retainer pay if such former member has waived a portion of his retired pay in order to receive such compensation), and does not consist of amounts paid, by way of reimbursement or otherwise, to such individual by his employer to defray expenses incurred by such individual in carrying out duties associated with his employment. " (g) I n determining the amount of any moneys due from, or payable by, the United States to any individual, there shall be excluded amounts which— " (1) are owed by such individual to the United States, •^' * *" ^-^

" (2) are required by law to be, and are, deducted from the remuneration or other payment involved, including but not limited ' to. Federal employment taxes, and fines and forfeitures ordered -' by court-martial,

- " '

" (3) are properly withheld for Federal, State, or local income tax purposes, if the withholding of such amounts is authorized or required by law and if amounts withheld are not greater than ,,; would be the case if such individual claimed all dependents to , • j -;, •, which he was entitled (the withholding of additional amounts pursuant to section 3402(i) of the Internal Revenue Code of 1954 may be permitted only when such individual presents evidence of a tax obligation which supports the additional withholding), " (4) are deducted as health insurance premiums, " (5) are deducted as normal retirement contributions (not including amounts deducted for supplementary coverage), or " (6) are deducted as normal life insurance premiums from salary or other remuneration for employment (not including . . amounts deducted for supplementary coverage).", (e)

CONSUMER PROVISIONS.—

(1) Subsection (b) of section 303 of the Consumer Credit Protection Act (15 U.S.C. 1673(b)) is amended— (A) by inserting " (1) " immediately after " (b) ", (B) by redesignating clauses (1), (2), and (3) thereof as clauses (A), (B), and (C),respectively,and .. (C) by adding at the end thereof the following new paragraph: " (2) The maximum part of the aggregate disposable earnings of an individual for any workweek which is subject to garnishment to enforce any order for the support of any person shall not exceed— " (A) where such individual is supporting his spouse or depend. ent child (other than a spouse or child with respect to whose support such order is used), 50 per centum of such individual's disposable earnings for that week: and

<,,. *

"*

' ~

�